There is no necessity to keep any other documents besides the signed ITR-V. Each envelope should only contain one ITR-V. The taxpayer should sign and keep the printed acknowledgement in an A4 envelope. If the assessee manually verifies the income tax returns, they must print a copy of the ITR-V form obtained by email or the income tax portal. To conclude the income tax filing process, a copy of the ITR-V acknowledgement should be signed in 'blue ink' and delivered to the Income Tax Department CPC. Taxpayers can also obtain a copy of ITR-V by visiting the income tax e-filing website. The income tax department provides ITR-V to taxpayers through email to verify the legitimacy of income tax returns.

A single-page document is received when an ITR is filed online without a digital signature.

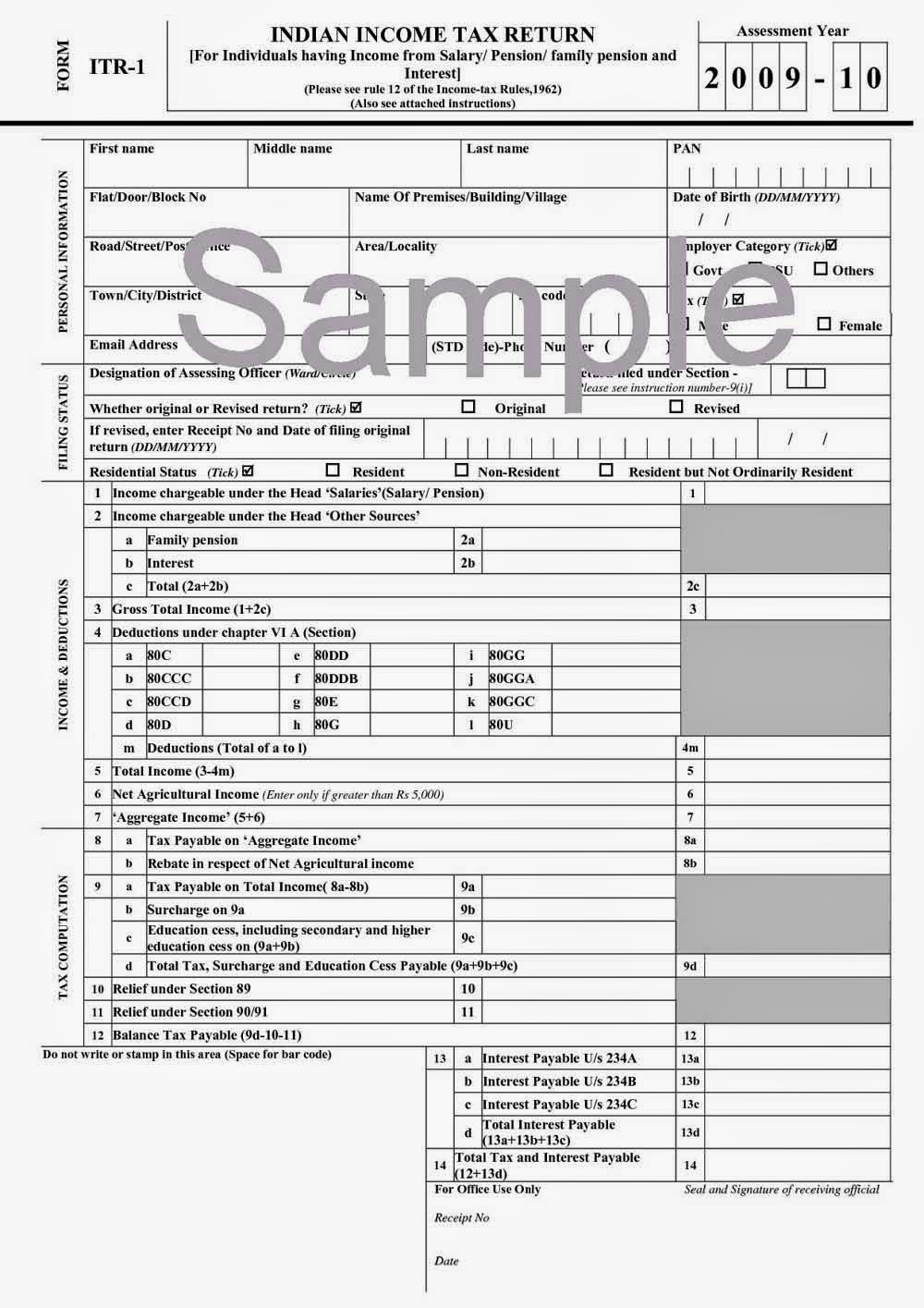

The abbreviation ITR-V stands for 'Income Tax Return-Verification' Form.

0 kommentar(er)

0 kommentar(er)